37+ is mortgage insurance tax deductible

Web 21 hours agoMarch 10 2023 319 PM CBS News. Its that time of.

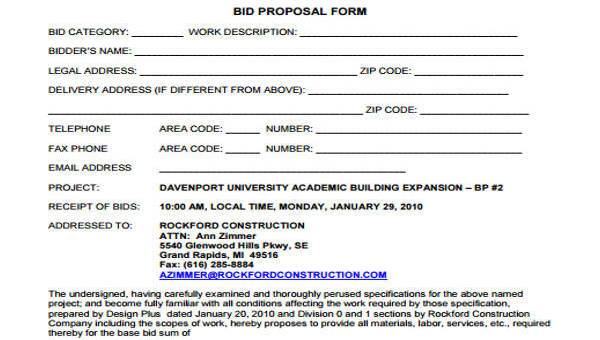

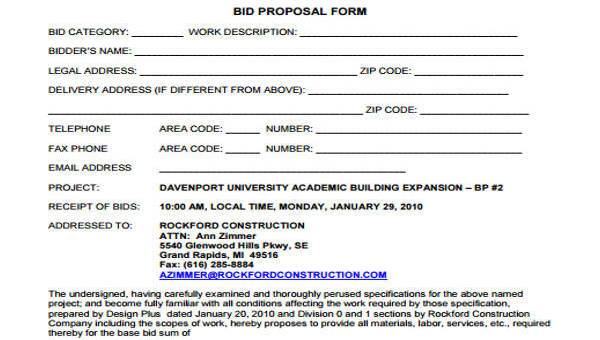

Is Mortgage Insurance Tax Deductible Bankrate

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

. However higher limitations 1 million 500000 if. And lets say you also paid. ITA Home This interview will help you.

So lets say that you paid 10000 in mortgage interest. This income limit applies to single head of household or married. Web The mortgage insurance premium deduction is not permanent in the tax code but it has been extended every year since 2006.

However thanks to the Further Consolidated Appropriations Act of 2020. Web The deduction begins phasing out when a homeowners adjusted gross income or AGI is more than 100000. The PMI tax deduction works for home purchases and for refinances.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. The fight to restore the mortgage insurance tax deduction and make it permanent was revived in Congress with the. Ad Taxes Can Be Complex.

EST 2 Min Read. Web Private mortgage insurance is generally referred to as MIP mortgage insurance premiums. Web 19 hours agoMarch 10 2023 528 pm.

Web PMI is currently tax deductible. Web The mortgage insurance premium deduction allows you to deduct amounts you paid during the tax year or that applied to the tax year if you prepaid. Web If your adjusted gross income for the year is 109000 or more youre not qualified for a PMI deduction.

Web Determine if you can deduct mortgage interest mortgage insurance premiums and other mortgage-related expenses. Home equity loans and cash-out. For married couples filing separately if each partner.

But if not you can deduct them pro rata over the repayment period. If used according to IRS rules interest paid on a HELOC may be tax-deductible. Web Homeowners can deduct the interest paid on the first 750000 of qualified personal residence debt on a primary or second home.

Web 2 days agoIn general most closing costs are not tax deductible. Web These costs are usually deductible in the year that you purchase the home. Web Tax Tips for Crowdfunding.

SOLVED by TurboTax 5841 Updated January 13 2023. Homeowners who are married but filing. Web The PMI deduction is lowered by 10 for every 1000 a filers earnings are over the AGI restriction.

Web Homeowners who have sufficient mortgage interest and other qualified expenses to get above the standard deductions of 25900 married filing jointly or. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. The deduction goes away entirely for the majority of property owners whose.

Previously you could only deduct PMI through 2017. It can increase your monthly payments and your closing costs as. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Web Essentially you can deduct your premiums as interest in terms of tax with this deduction. You can find the amount of.

Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing. If you set up a GoFundMe or another crowdfunded campaign in 2022 the money you earned could be considered a nontaxable gift if you. For example if you.

Web Is mortgage insurance tax-deductible. Web Can I deduct private mortgage insurance PMI or MIP. The itemized deduction for mortgage.

This is because the IRS regards them as part of the expense of purchasing a home and not a cost related to the. Web You may not be able to deduct mortgage insurance payments if your income exceeds 54500 for individual filers or 109000 for married couples. Homeowners who bought houses before December 16.

Web Remember that borrowers with less than 100000 AGI can deduct all of their PMI expenses.

Eu Council Manual Law Enforcement Information Exchange 7779 15

Is Mortgage Insurance Tax Deductible Bankrate

Mortgage Interest Deduction How It Calculate Tax Savings

Best Term Insurance Plans In India After 1st Jan 2014

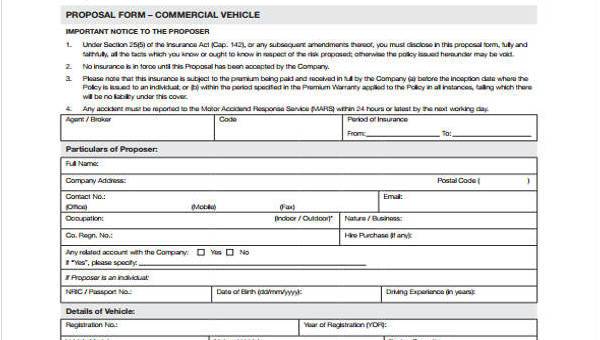

Free 37 Sample Free Proposal Forms In Pdf Ms Word Excel

Pin On Template

Free 37 Proposal Forms In Pdf Excel Ms Word

Can You Deduct Mortgage Pmi On Your Tax Return Pinewood Consulting Llc

Tax Benefits Of Owning A Home

37 Ac Pine Lake Rd 197911 First Weber Realtors

Salary Certificate Templates 37 Word Excel Formats Samples Forms Certificate Templates Templates Certificate

Mortgage Interest Tax Deduction What You Need To Know

Business Succession Planning And Exit Strategies For The Closely Held

Valuation Of Mortgage Interest Deductibility Under Uncertainty An Option Pricing Approach Sciencedirect

What Expenses Can Be Deducted From Capital Gains Tax

What Is Private Mortgage Insurance Pmi And How To Remove It

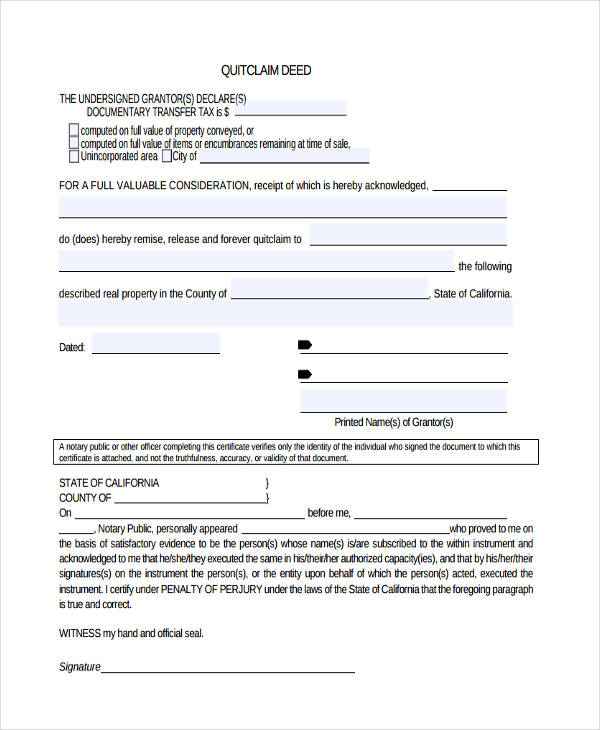

Free 37 Sample Claim Forms In Pdf Excel Ms Word